Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

/in 2020 Only, Blog, Coronavirus /by Orna ElizurThe sheer volume of applications for the Canada Emergency Response Benefit (CERB) will likely overwhelm the system. If you or someone you know need to apply for this benefit, we suggest you prepare TODAY before the applications begin:

-

Double check your myCRA account username and password

-

Direct Deposit is setup

-

3 – 5 days via Direct Deposit vs 10 days via cheque in the mail

-

You should double check your myCRA username and password by signing in at:

If you do not have direct deposit setup with CRA, you can set it up TODAY at:

To help manage the volume, the CRA has setup specific days for you to apply based on month of birth.

If you were born in the month of:

-

January | February | March: Mondays – Best day to apply is April 6th

-

April | May | June: Tuesdays – Best day to apply is April 7th

-

July | August | September: Wednesdays – Best day to apply is April 8th

-

October | November | December: Thursdays – Best day to apply is April 9th

-

Fridays, Saturdays and Sundays are open for any birth month

Eligibility

The benefit will be available to workers:

-

Residing in Canada, who are at least 15 years old;

-

Who have stopped working because of COVID-19 and have not voluntarily quit their job or are eligible for EI regular or sickness benefits;

-

Who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

-

Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment or self-employment income.

Do I Qualify for the Canada Emergency Response Benefit & EI?

/in 2020 Only, Blog, Coronavirus /by Orna ElizurTo help Canadians through this difficult time, the Federal Government created the Canada Emergency Response Benefit (CERB) and made changes to the Employment Insurance Program (EI). For those whose employment has affected by the Coronavirus, we have created a chart to help you figure out which program you qualify for and provide links to apply for each program.

The Federal Government has already made numerous changes to these programs so we will be updating this document whenever a change to the program is made.

Stay home and stay safe.

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

/in 2020 Only, Blog, Business Owners /by Orna ElizurMarch 27, 2019 – Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

Wage Subsidy increased to 75%

The Prime Minister has been under pressure from the small business community to boost the wage subsidy beyond the 10% initially announced to help keep people employed. Today, Mr. Trudeau announced the government will increase the wage subsidy from 10% to 75% to help keep employees on the payroll. This increase will be backdated to Sunday, March 15th.

“It is clear we have to do more, much more so we are bringing that percentage up to 75 per cent for qualifying businesses”

– Prime Minister Justin Trudeau

Canada Emergency Business Account (CEBA)

The CEBA will allow banks to offer $40,000 loans that will be interest-free for the 1st year which will be guaranteed by the government. If you meet certain conditions, $10,000 of the loan can be forgivable.

“To help you bridge to better times, we are launching the Canada Emergency Business Account. With this new measure banks will soon offer $40,000 which will be guaranteed by the government”

Defer GST, HST, Duty

The government will defer GST & HST payments, as well as duty and taxes owed on imports until June 2020.

“This is the equivalent of giving $30-billion of interest free loans to businesses”

Bank of Canada Rate Cut

Bank of Canada slashed its key overnight interest rate to 0.25%.

Full details and qualification requirements will be available on Monday.

Canada Emergency Response Benefit to help workers and businesses

/in 2020 Only, Blog /by Orna Elizur$2,000/month for 4 months – Canada Emergency Response Benefit to help workers and businesses

To support workers and help businesses keep their employees, the government has proposed legislation to establish the Canada Emergency Response Benefit (CERB). This taxable benefit would provide $2,000 a month for up to four months for workers who lose their income as a result of the COVID-19 pandemic. The CERB would be a simpler and more accessible combination of the previously announced Emergency Care Benefit and Emergency Support Benefit.

The CERB would cover Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. The CERB would apply to wage earners, as well as contract workers and self-employed individuals who would not otherwise be eligible for Employment Insurance (EI).

Additionally, workers who are still employed, but are not receiving income because of disruptions to their work situation due to COVID-19, would also qualify for the CERB. This would help businesses keep their employees as they navigate these difficult times, while ensuring they preserve the ability to quickly resume operations as soon as it becomes possible.

The EI system was not designed to process the unprecedented high volume of applications received in the past week. Given this situation, all Canadians who have ceased working due to COVID-19, whether they are EI-eligible or not, would be able to receive the CERB to ensure they have timely access to the income support they need.

Canadians who are already receiving EI regular and sickness benefits as of today would continue to receive their benefits and should not apply to the CERB. If their EI benefits end before October 3, 2020, they could apply for the CERB once their EI benefits cease, if they are unable to return to work due to COVID-19. Canadians who have already applied for EI and whose application has not yet been processed would not need to reapply. Canadians who are eligible for EI regular and sickness benefits would still be able to access their normal EI benefits, if still unemployed, after the 16-week period covered by the CERB.

The portal for accessing the CERB would be available in early April.

Canadians would begin to receive their CERB payments within 10 days of application. The CERB would be paid every four weeks and be available from March 15, 2020 until October 3, 2020.

BC Government supporting renters, landlords during COVID-19

/in 2020 Only, Blog /by Orna Elizur$500/month towards rent

To support people and prevent the spread of COVID-19, the Province is introducing a new temporary rental supplement, halting evictions and freezing rents, among other actions.

The new rental supplement will help households by offering up to $500 a month towards their rent, building on federal and provincial financial supports already announced for British Columbians facing financial hardship.

“Nobody should lose their home as a result of COVID-19. Our plan will give much-needed financial relief to renters and landlords. It will also provide more security for renters, who will be able to stay in their homes without fear of eviction or increasing rents during this emergency.” – Premier John Horgan

The funds will support renters experiencing a loss of income by helping them pay their rent and will be paid directly to landlords on their behalf, to ensure landlords continue to receive rental income during the pandemic. Benefiting people with low to moderate incomes, this supplement will be available to renters who are facing financial hardship as a result of the COVID-19 crisis, but do not qualify for existing rental assistance programs.

The Province is implementing a number of additional measures to keep people housed and protect their health. The full list of immediate measures includes:

-

The new temporary rent supplement will provide up to $500 per month, paid directly to landlords.

-

Halting evictions by ensuring a landlord may not issue a new notice to end tenancy for any reason. However, in exceptional cases where it may be needed to protect health and safety or to prevent undue damage to the property, landlords will be able to apply to the Residential Tenancy Branch for a hearing.

-

Halting the enforcement of existing eviction notices issued by the Residential Tenancy Branch, except in extreme cases where there are safety concerns. The smaller number of court ordered evictions are up to the courts, which operate independently of government.

-

Freezing new annual rent increases during the state of emergency.

-

Preventing landlords from accessing rental units without the consent of the tenant (for example, for showings or routine maintenance), except in exceptional cases where it is needed to protect health and safety or to prevent undue damage to the unit.

-

Restricting methods that renters and landlords can use to serve notices to reduce the potential transmission of COVID-19 (no personal service and allowing email).

-

Allowing landlords to restrict the use of common areas by tenants or guests to protect against the transmission of COVID-19.

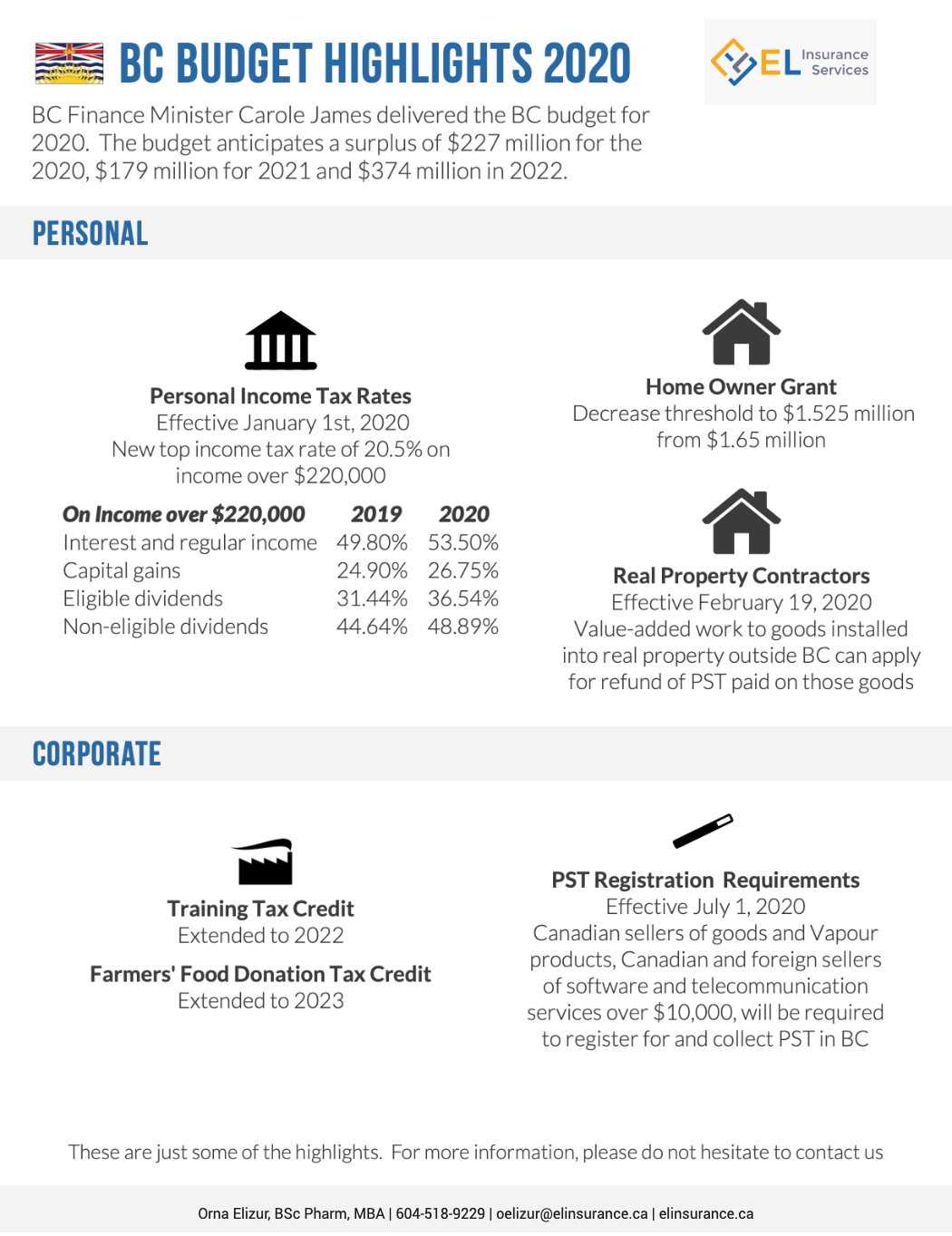

2020 BC Budget

/in 2020 Only, Blog /by Orna Elizur

BC’s Finance Minister Carole James delivered the province’s 2020 budget on

February 18, 2020. The budget projects:

-

For 2020, a surplus of $227 million

-

For 2021, a surplus of $179 million

-

For 2022, a surplus of $374 million

Personal Tax Changes

Personal income tax rates

Effective January 1, 2020, a new top British Columbia personal income tax rate of 20.5% (up from 16.8%) that will apply to individuals with taxable income exceeding $220,000. As a result, the charitable donation tax credit will also increase to 20.5% for charitable donations over $200 for taxpayers in the new bracket.

Home Owner Grant

BC will decrease the threshold for the phase-out of the home owner grant from $1.65 million to $1.525 million. For properties above the threshold, the grant is reduced by $5 for every $1,000 of assessed value in excess of the threshold.

Real property contractors

Effective February 19, 2020, the budget allows real property contractors who perform value-added work to goods and then install those goods into real property outside the province to apply for refunds of PST paid on those goods.

Training Tax Credit

Extended to the end of 2022

Farmers’ Food Donation Tax Credit

Extended to the end of 2023

Corporate Tax Changes

Film Incentive BC and production services tax credit

Effective February 19, 2020, the budget increases the accreditation certificate fee for the Production Services Tax Credit from $5,500 to $10,000.

Production Services Tax Credit Pre-Certification Notification Introduced

Effective July 1, 2020, corporations intending to claim the production services tax credit

must notify the certifying authority of their intent within 60 days of first incurring an

expenditure eligible for the tax credit.

Training Tax Credit

Extended to the end of 2022

Farmers’ Food Donation Tax Credit

Extended to the end of 2023

New Mine Allowance

Effective date to be specified, extended to the end of 2025

PST Registration Requirement

Effective July 1, 2020, Canadian sellers of goods, along with Canadian and foreign sellers of software and telecommunication services will be required to register as tax collectors if specified B.C. revenues exceed $10,000. Additionally, all Canadian sellers of vapour products will be required to register if they

cause vapour products to be delivered to B.C. consumers.

Sales Tax Changes

Carbonated Beverages

Effective July 1, 2020, carbonated beverages that contain sugar, natural sweeteners or artificial sweeteners will no longer qualify for the PST exemption for food products. PST will also apply to beverages that are dispensed through soda fountains, soda guns or similar equipment, along with

all beverages dispensed through vending machines (except vending machines wholly

dedicated to dispensing beverages other than sweetened carbonated beverages, e.g., coffee

or water machines)

Carbon Tax Rates Aligned with Federal Carbon Pricing Backstop Rates

Effective April 1, 2020, the B.C. carbon tax rates for 2020 and 2021 are aligned with

the federal carbon pricing backstop methodology, where applicable. As part of this

alignment, the current B.C. rates for shredded and whole tires are also being replaced

with a new category for “combustible waste”. Combustible waste includes tires in

any form, asphalt shingles as a new taxable combustible and any prescribed material,

substance or thing.

B.C. carbon tax rates are being updated to ensure they are in line with the latest science

on emissions. The previous rates were set in 2008 and are today considered to be based

on old science. For some fuel types, the rates are lower than their original scheduled rates.

For example, the tax rate for gasoline will be 9.96 cents per litre on April 1, 2020, rather

than 10.01 cents per litre. For some fuel types, the rates are higher than their original

scheduled rates. For example, the tax rate for natural gas will be 8.82 cents per cubic

metre on April 1, 2020, rather than 8.55 cents per cubic metre. The new rates will be

available on the Ministry of Finance’s website.

The B.C. carbon tax rates will be reviewed as part of the federal government’s review of

the Pan-Canadian Framework on Clean Growth and Climate Change in 2022.

Tax Rate for Heated Tobacco Products Introduced

Effective April 1, 2020, a default tax of 29.5 cents per heated tobacco product is

introduced. For specific heated tobacco products, this default can be changed by

regulation. A heated tobacco product is a product that contains tobacco and is designed

to be heated, but not combusted, in a tobacco heating unit to produce a vapour for

inhalation.

Property Transfer Tax

Exemption from Additional Property Transfer Tax for Certain Canadian-Controlled

Limited Partnerships Introduced

Effective on a date to be specified by regulation, a new exemption from additional

property transfer tax will be introduced for qualifying Canadian-controlled limited

partnerships. This exemption will treat Canadian-controlled limited partnerships in a

manner more consistent with Canadian-controlled corporations. It will ensure that new

housing developments are treated similarly irrespective of whether the development is

being undertaken by a Canadian-controlled corporation or Canadian-controlled limited

partnership.

The entire BC Budget can be found at https://www.bcbudget.gov.bc.ca/2020/downloads.htm#gotoNewsReleases

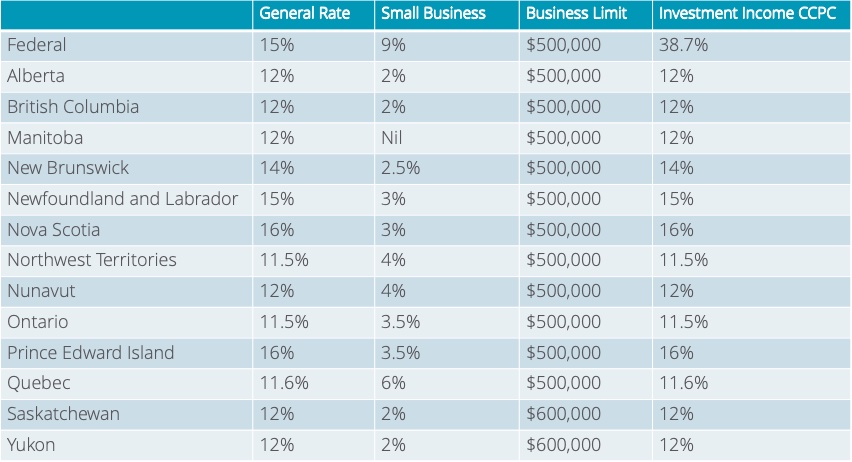

Investing as a Business Owner

/in Blog, Business Owners, corporate, Investment, rrsp, Tax Free Savings Account /by Orna ElizurInvesting as a Business Owner

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as:

-

building and protecting your savings

-

providing for loved ones

-

planning for retirement

Factors to consider when investing as a corporation:

What’s the purpose of the investment? First, think about what you’ll be doing with your savings. This will help dictate what savings vehicle is best suited for your situation. Then consider the following factors:

-

Taxes: As a small business owner, you have access to the small business tax rate which is typically lower than your personal tax rate. (See table below.) Also, as of January 1, 2019, the Federal Budget decreased the small business limit for corporations with a set threshold of income generated from passive investments.

2019 Corporate Income Tax Rates

-

Taxes on investment growth: Depending on what you invest in, you will want to review this as different asset types are taxed at different rates.

-

Timing: You can control the timing of the payout which means you could potentially defer paying out the money until you need it and determine if you’d like to pay it out as salary or dividend.

-

Creditor Protection: Sometimes, investments held inside a corporation can be vulnerable to creditors, therefore you may want to consider using a holding company or trust or pay out money to yourself personally. This can be complex and requires professional advice.

-

Capital Gains Exemption: If your investment grows too large, it may endanger your qualification for the lifetime capital gains exemption that ‘s available when shares of a qualified small business corporation are sold or transferred.

For business owners, before investing personally or corporately, it’s certainly worth seeking professional advice to ensure that it suits your individual circumstances.

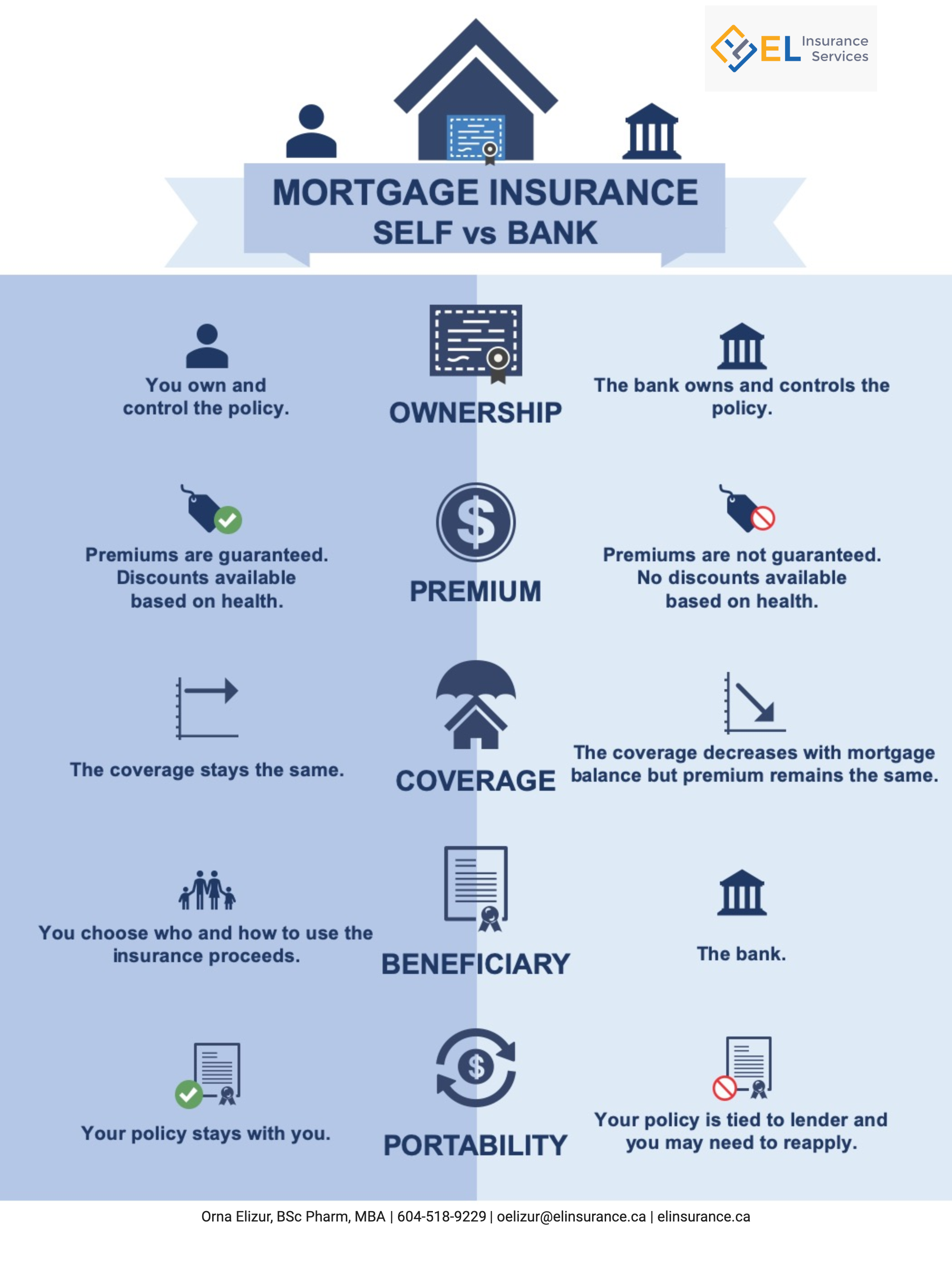

The Best Way to Buy Mortgage Insurance

/in Blog, Family, individuals, life insurance /by Orna ElizurBefore buying insurance from your bank to cover your mortgage, understand the difference between self owned mortgage life insurance and bank owned life insurance. The key differences are ownership, premium, coverage, beneficiaries and portability.

Ownership:

-

Self: You own and control the policy.

-

Bank: The bank owns and controls the policy.

Premium:

-

Self: Your premiums are guaranteed at policy issue and discounts are available based on your health.

-

Bank: Premiums are not guaranteed and there are no discounts available based on your health.

Coverage:

-

Self: The coverage that you apply for remains the same.

-

Bank: The coverage is tied to your mortgage balance therefore it decreases as you pay down your mortgage but the premium stays the same.

Beneficiary:

-

Self: You choose who your beneficiary is and they can choose how they want to use the insurance benefit.

-

Bank: The bank is beneficiary and only pays off your mortgage.

Portability:

-

Self: Your policy stays with you regardless of your lender.

-

Bank: Your policy is tied to your lender and if you change, you may need to reapply for insurance.

We’ve created an infographic about the difference between personally owned life insurance vs. bank owned life insurance.

Talk to us, we can help.

1 in 3 Canadians Will Become Disabled Before the Age of 65

/in Blog /by Financial Tech ToolsWhat you need to know about your Group Long Term Disability

Having a source to replace your earned income in the event of an illness or accident is vital considering that on average, 1 in 3 Canadians will become disabled for a period of more than 90 days at least once before the age of 65. For those that are disabled for more than 90 days the average length of that disability is 2.9 years.

Read more

EL INSURANCE SERVICES

ORNA ELIZUR, CFP®, BSC PHARM, MBA

CERTIFIED FINANCIAL PLANNER PROFESSIONAL

Tel: 604-518-9229

Email: oelizur@elinsurance.ca